Translate this page into:

Social Impact Bonds: An Innovative Mechanism of Funding for Social Problems in Developing Countries

Address for correspondence: The Editor/ Managing Editor, Journal of Comprehensive Health, Dept of Community medicine, NRS Medical College, 138, AJC Bose Road, Kolkata-700014

Corresponding author: Rabindra Nath Roy, Associate Professor, Community Medicine, Burdwan Medical College, Burdwan. e-Mail : rabinroy59@yahoo.co.in

Abstract

In today's complex world the government resources and charitable donations are insufficient to address the world's social problems. An impact investment offers a new alternative for channeling private capital for social benefit. Social Impact Bonds (SIB) an innovative financial instrument which facilitates fund flows to address major social problems. It is a public-private partnership that drives government resources toward social programmes.

Keywords

Social Impact Bond

Development Impact Bond

Social Finance

Introduction:

During the last few decades the world has witnessed unprecedented improvements in health, education, equality, security and human rights, with aid agencies having played an important role. However, since last two decades, especially following the global economic and financial crisis, programs addressed towards social issues are facing difficulties to arrange adequate funds. The government resources and charitable donations are not sufficient to address the world's social problems, particularly in developing countries. The re- configuration of public expenditures has undergone significant changes that have posed new challenges, opportunities and threats to welfare policies and to their financing[1]. Underinvestment in social welfare measures is a common phenomenon worldwide; money does not always flow to where it is most needed.

Clearly, more funds will be needed if the social goals are to be met. Social finance and an impact investment offer a new alternative for channeling private capital for social benefit[2]. Social finance (SF) is defined as “an umbrella term for financial products and services that strive to achieve a positive social, environmental or sustainability impact[3]. Among the broad range of the SF spectrum, Social Impact Bond (SIB) is an innovative financial instrument to address major social problems which facilitates fund flows for welfare measures and social services. SIBs are also referred to as Pay-for-Success Bonds which have enormous potential to transform the social sector and support vulnerable communities. Through this investment instruments, the nonprofit service providers, investors, and governments attempt to improve the social outcome by delivering some targeted interventions. SIBs derive their name from the fact that investors are typically those who are interested in not just the financial return on their investment, but also in its social impact beyond financial returns[2,4,5] SIBs offer governments a risk-free way of pursuing creative social programs that may take years to yield results[5]. Basically, SIB is a collaborative outcome-based approach to ensure availability of funds by bringing public and private actors together to tackle some of the existing problems of society. A partnership between government, non-profits, and investors may lead to more effective social services spending[6]. The extension of the scope of the SIB in developing countries implies the use of Developing Impact Bonds (DIBs). The DIBs are an adaptation of Social Impact Bonds, the distinctive feature of which is that in countries whose governments cannot yet afford the full cost of additional public services, donors provide some or all of the repayment to investors when the results are proven. The impact bonds have been described by different names: SIBs in Europe, ‘Pay-for-success (PFS)’ in the United States, Social Benefit Bonds (SBBs) in Australia and Development Impact Bonds (DIBs) in which development agencies and governments pay for success[3].

Based on this assumption, the present work aims to review the role and usefulness of SIBs and DIBs for developing countries.

Aims of SIB:

The Social Impact Bond aims to address a social problem, main objectives are to[5]:

Align public sector funding more directly with evidenced based improved social outcomes;

It provides a platform for collaboration to broad diversity of service providers.

Increase the pool of capital available to fund effective intervention for a social problem and ensure a greater certainty over revenue stream for service providers.

Encourage a more rigorous approach to performance management and objective measurement of outcomes which contributes to building a broader evidence base for what works

Scope and limitations:

Social Impact Bonds are suitable for wide variety of social problems including preventive interventions for diseases However, in many cases, a SIB may not be relevant some of which are stated below:

There are many services, particularly in the field of health care where it would be more appropriate to fund on the basis of activity rather than outcomes.

There are situations where it is difficult to prove that any change in outcomes is due to the impact of the new programme rather than external factors.

In some services there will be limited or no benefits or opportunities associated with risk taken by the investors.

Features of a Social Impact Bond:

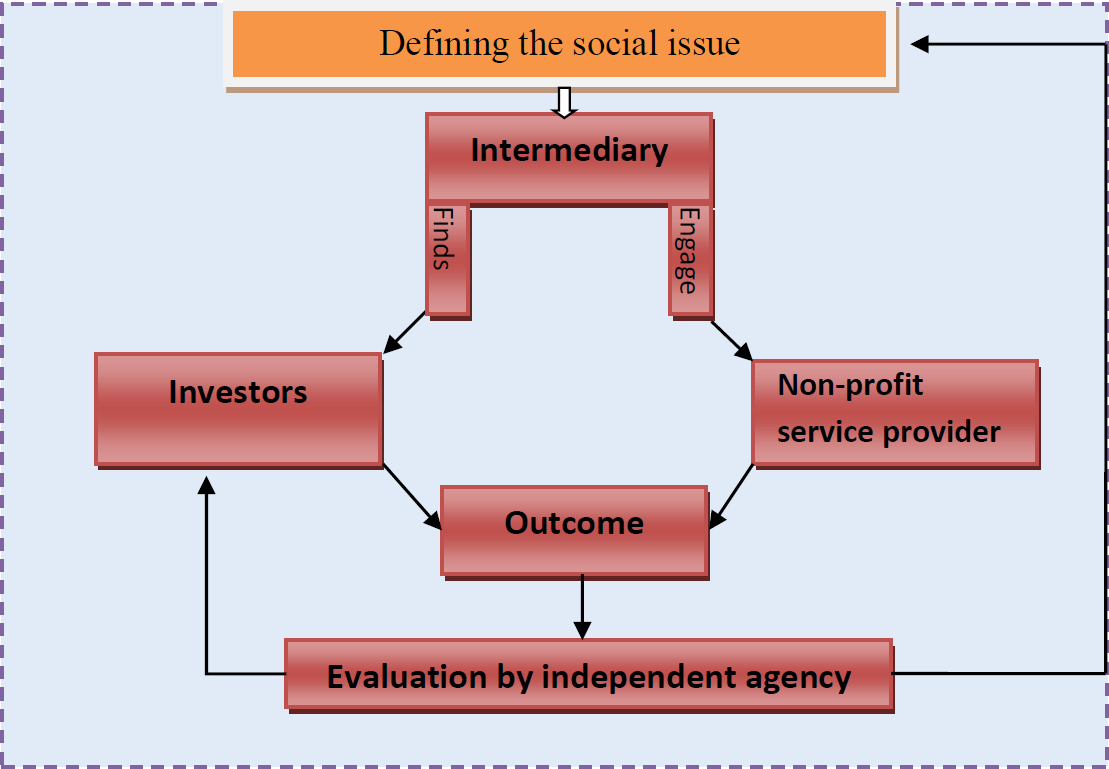

Usually, governments decide on the problems that need to be addressed and enter a contractual agreement with an intermediary (or bond-issuing organization) that is responsible for raising capital from independent investors and managing the programme. It motivates investors to provide fund for the specified problems. The fund may be mobilized from number of investigators and pooled together[6]. The intermediary would commission a nonprofit service provider to deliver the intervention on their behalf. If the project achieves its stated objectives, investors will receive payments from government. These payments repay the initial investment plus a financial return. The financial return is dependent on the degree to which outcomes improve[5].

Intermediaries : Experienced organizations serve as SIB intermediaries to develop the model interventions and for raising investment capital and providing long-term project management. They hire external agencies to execute the service delivery. For example The Social Finance UK, a nongovernmental organization (NGO) acted as intermediatory for managing a social intervention project[7].

Investors – investors are the agencies who provide fund the activities under the project

Target beneficiary- Need a target beneficiary that is benefited from the services.

Evaluation advisers and independent assessors : Independent agencies that evaluate and measure the outcomes

- The diagram below illustrate how a SIB can works

Steps for development SIB:

The process of development of SIB is not linear and is dependent upon a series of interconnected sub-steps and other factors like potential cost savings, returns to investors and sustainability of the programme.

Defining the social issue

First is to identify a problem that needs to be addressed. It should seek answer to the questions, “what is the pressing social need?”, “who are the vulnerable or affected group?”, “is there any amenable solution to it?” etc. This requires collection and analysis of relevant data from the population and discussion with different stake holders to understand the problem. The defined problem should not be too diffuse to have a significant impact of addressing the issue on the target outcome on other hand if the definition is too narrow, the target population may not be sufficient to require a dedicated service[5].

Identifying investors and investments : A variety of investors such as banks, foundations, other financial institutes, private wealth managers, companies, donor agency, individuals etc may participate as investors. These investors operate across multiple business sectors, including agriculture, water, housing, education, health, energy and financial services[2].

Where domestic resources for funding are available, emerging economy governments, including local authorities, could develop SIBs, with funding and assistance from donors if necessary[2]. SIB costs include the cost of interventions and its implementation, cost of conducting evaluation and project management cost.

Contract terms and conditions:

It is an outcomes-based contracting system where a contract agreement is made between the investors and intermediatory (fund manager) to repay the cost at agreed rate if desired target or goal is reached. The contract document should include information about the target population, details of the intervention, investment structure, payment in different performance scenarios, program evaluation etc. If achievement is greater than the stated minimum threshold return, the investors may be given be higher return; this act as incentive for better performance. For example, in UK an SIB was designed to reduce the re-offending rate among prisoners promised a minimum repayment of 2.5% of capital investment if re-offending is reduced by at least 7.5%

Define the outcome metric(s):

In social science, ‘impact’ is describes as outcome(s) that can be attributed to a particular intervention[2]. The outcome metrics has to be developed against which success could be assessed. The outcome metrics is the foundation of the SIB contract between the public sector and investors. The outcome metrics should clearly define what would be considered as a successful or a failed outcome. The metrics may be a combination of objective and subjective metrics, some of which would be linked to investor payments[5]. The basket of metrics should be so chosen that right incentives are generated for the various stakeholders involved. The “HMP Peterborough” Social Impact Bond has used reduction in the re-offending rate over the 12 months as outcome matrix[1].

Establishing a measurement framework:

The measurement framework is prepared which act as benchmark against which success and failure of SIB outcomes are measured. The benchmark reflects outcomes in the absence of SIB interventions. There are various methods of generating a benchmark namely historical data or contemporaneous data for an equivalent population, pre- and post- intervention measurements for target group and live baseline or control group.

Defining the intervention(s):

An intervention describes the nature of services to be funded in order to achieve success metrics. First exercise is to identify a problem and assess need of the target group to be addressed. This requires collection and analysis of relevant data from the population and discussion with different stake holder to understand the problem. Once the profile of needs is understood an intervention programme can be developed. At this stage both national and local service providers must be consulted to identify where complementary interventions could best meet the needs of the target population and achieve the desired outcome. Interventions should be evidence-based. It is necessary to estimate the cost for providing these services and support to programe and use an intervention that would reduce the cost associated with the services.

Programme design:

Once the SIB is approved by investors and other partners a plan for implementation should be prepared. The detailed operating plan include estimation of the number of expected users for a SIB-funded service, baseline outcomes measurement prior to the start of service delivery, methods and time for measurement of the final results of the programme and payment terms etc, for implementation

Evaluation of outcome:

An independent evaluator, agreed upon on by both parties, is hired to measure the outcomes as stated in the contract document and resolve any disputes that arise. Once independently verified evidence shows that results have been achieved, the government and donors repay the investors their principal plus a financial return linked to performance.

The Use of SIBs:

Many countries have now started deploying Social Impact Bonds and paid - for-success contracts[7] SIB, as a financing instrument for welfare services has been implemented since 2010, especially in the UK, in the US and Australia, to facilitate impact investments[1].

The United Kingdom pioneered the use of SIBs in 2010, which is popularly Known as Peterborough Prison Bond 2010 - 2015. The project intended to reduce one-year recidivism rates among the released prisoners of short-sentence offenders through rehabilitation service. The recidivism rate of these prisoners would be compared with similar prisons that were not enrolled in the rehabilitation program[8]. Evidence from research literature from different countries reveal that an effective programs can reduce the recidivism rate by a maximum of 20% approximately[9] Since then the use of SIBs have been increasing in UK and other parts of the world. In 2013, Baker Tilly and the Consortium of Voluntary Adoption Agencies (CVAA) launched “It's All About Me” (IAAM), an innovative ten year scheme to help hundreds of children in local authority care find permanent homes with therapeutically trained adoptive families.

Though the SIB has predominantly deployed in developed countries, it has immense potential for application in developing countries. Analysis of case studies from developing countries have shown many potential area of application of impact investment in developing countries, some example are cited below[2].

Community filtration units for supply of clean water to below poverty population,

Maternal health provision, particularly the attendance of births by a skilled professional when otherwise a professional would not have been present.

Gyan Shala, a form of one-room schools in the urban slums of India operated by a not-for profit organization for low income group confirmed a strong willingness to pay school fees at a level that would sustain the business model commercially

Broad objective of post- MDG Sustainable Development Goals (SDG) is to provide a sustainable framework for development through eradication of poverty and deprivation, improvement of economies, protection of health and environment, promotion of good governance etc., implementation of which will be dependent on sufficiency of funds. But, public sector funding allocations are prioritised towards acute felt concerns of the countries. In this environment, SIBs/DIBs have enormous potential of providing financial support to the programs by attracting private capital for a variety of social and environmental causes to strive for desired outcomes of SDGs.

Conclusion:

Social Impact Bonds have been the instrumental for channeling private capital for solutions to wide range of social problems. With further experience of using SIB in developing countries could be alternate model for mobilizing private capital for social benefits linked with evidenced based improved social outcomes. With wider application it will encourage nonprofits to develop robust data collection methods, create performance metrics, and measure social outcomes.

References:

- Mobilizing private finance for public Good: challenges and opportunities of Social impact bonds. European Scientific Journal /SPECIAL/ (1) ISSN: 1857 - 7881 (Print) e - ISSN 1857-7431

- [Google Scholar]

- Impact investment – An emerging assets class. 2010 at https://www.rockefellerfoundation.org/app/uploads/Impact-Investments-An-Emerging-Asset-Class (accessed )

- [Google Scholar]

- Social Finance and Impact Investing. . 2012;3 available at http://dx.doi.org/10.2139/ssrn.2160 403 (accessed )

- [CrossRef] [Google Scholar]

- Guide to Social Impact Bond Development. 2013 January at http://www.socialfinance.org.uk/wp-content/uploads/2014/05/Technical-Guide-to-Developing-Social-Impact-Bonds (accessed )

- [Google Scholar]

- Social Impact Bonds. http://harvardmagazine.com/2013/07/social-impact-bonds (accessed )

- [Google Scholar]

- Evaluating Social Impact Bonds as a New Reentry Financing Mechanism: A Case Study on Reentry Programming in Maryland. 2013 at http://mgaleg.maryland.gov (accessed )

- [Google Scholar]

- “Introduction to Social Impact Bonds,”. 2014 October 21 accessed at http://socialfinance.westgatecom ms.com/wp-content/uploads/2014/07/Introduction-to-Social-Impact- Bonds.pdf

- [Google Scholar]

- Evaluating Social Impact Bonds as a New Reentry Financing Mechanism: A Case Study on Reentry Programming in Maryland. 2013 at http://mgaleg.maryland.gov (accessed )

- [Google Scholar]